Follow us

10 Street Name, City Name Country, Zip Code555-555-5555myemail@mailservice.com

COMPLIANCE-FIRST TAX CREDIT CONSULTANCY

Experienced IRS Attorney Joins OnCentive as Special Counsel For Tax Compliance

Serving as Senior Attorney at the Office of Chief Counsel (IRS) for thirteen years, Gregory brings a wealth of tax compliance knowledge to OnCentive, furthering the firm’s commitment to providing the most compliant tax credit solutions and services to the market.

"Before accepting a role with OnCentive, I reviewed their policies and procedures regarding Employee Retention Credit (ERC), IRS inquiries, and audit oversight and found that our standards on compliance and service aligned. I am excited to join a consultancy that is committed to maintaining the highest standards in the industry and delivering exceptional service."

Garrett Gregory

Special Counsel For Tax Compliance

Be Rewarded For Doing Business As Usual

Capture Tax Credits &

Increase Profitability.

The US government offers over 3,000 state & federal incentive programs to reward business owners for basic business functions like retaining employees, job creation, innovating internal processes and more.

OnCentive makes it easy for businesses to access and secure lucrative incentives and tax credits. As your trusted profitability partner, we handle all the paperwork and legwork, so you can focus on growing your business. Best of all, our services come with no risk to you – you'll receive all the benefits, with none of the hassle.

$3 Billion

CAPTURED CREDITS

$0

UPFRONT COST

150+ Years

CREDIT EXPERIENCE

100%

AUDIT SUPPORT

-

COVID-19

Learn MoreERC

-

State & Federal

Learn MoreR&D CREDIT

-

Hiring InCentives

Learn MoreWOTC

-

Energy Tax Credits

Learn MoreSOLAR CREDITS

CREDIT SPOTLIGHT:

Covid-19 Employee Retention Credit

The Employee Retention Tax Credit (ERC) is a refundable tax credit that encourages businesses to keep employees on their payroll.

Introduced by the CARES Act, it’s worth up to $5,000 per employee in 2020 and up to $7,000 per employee per quarter in 2021 (for the first three quarters), for a max credit of $26,000 per employee.

$26,000

maximum credit amount

$1Billion+

refundable ERC credits secured for clients

Fast Funding

Through our trusted funding partner, you can receive your ERC in weeks versus waiting months on the IRS.

Pay When You Get Paid

OnCentive works on success-based fees which means you pay only once you receive your credits.

Full Service Processing

With our platform, you’ll save time when you most need it, while serving your customers.

NO MORE WAITING ON THE IRS

Accelerate Refunds with OnCentive's Funding:

Receive your ERC in WEEKS

At OnCentive, we're dedicated to providing a fast and reliable solution to the long wait for your Covid-19 Employee Retention Tax Credits. Thanks to our network of trusted funding partners, we can offer you funding within just a few weeks - bypassing the typical eight to nine-month wait from the IRS.

Meet Our Tax Credit & Financial Experts

Shannon Scott

CEO & Cofounder

Chris Smith, CPA

President

Frank Brown, J.D., LL.M.

Chief Incentive Officer & Cofounder

Garrett Gregory, Esq., LL.M.

Special Counsel for Tax Compliance

Joshua Hole, CPA, MT

President of Special Incentives

Roger Boatner, CPA

Partner

Schedule a call with an OnCentive Expert

Don’t Disqualify Yourself. Our Experts Determine Your Eligibility For Free.

Despite its meaningful impact, only 1% of qualified employers have filed

for ERTC in 2020 and only 3% in 2021.

In The News

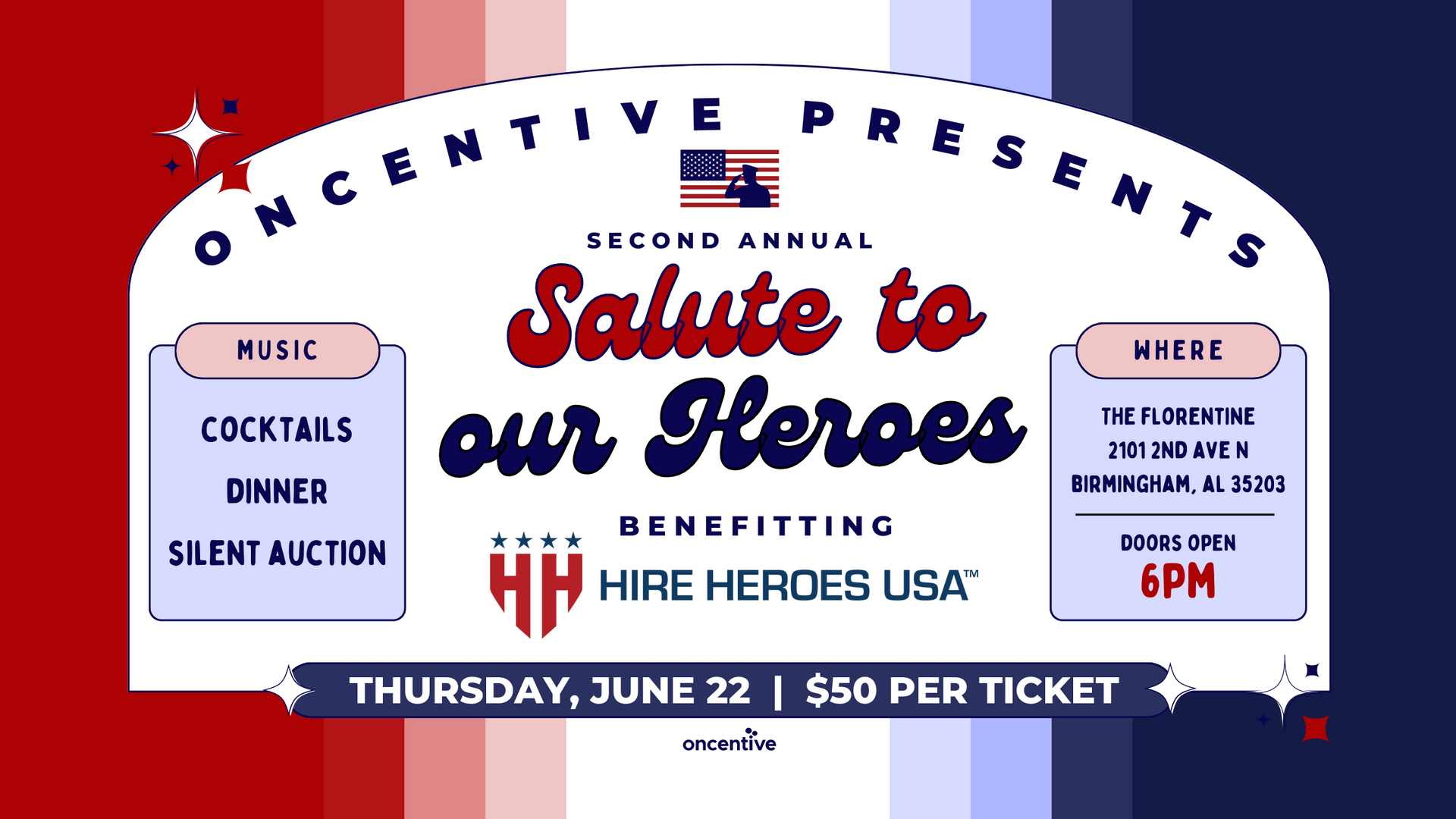

OnCentive Amplifies Support for Veterans with Second-Annual 'Salute to Our Heroes' Fundraising Event

Blog

-

Industry Expertise

Learn more →OnCentive has the expertise and

knowledge to maximize your tax

credits while maintaining

compliance.

-

Simplified Processing

Learn more →Our risk-free model puts your hard

earned money back in your hands

so you can use it to grow your

business.

-

Thought Leadership

Learn more →Frequently consulting the House

Ways and Means & Senate Finance

Committees, OnCentive stays

abreast of the latest legislative news

impacting tax credits and

incentives.

What Clients Say About OnCentive:

Don't just take it from us.

Morgan Akins, The Arc of Tuscaloosa

"The OnCentive team helped our non-profit raise hourly wages to attract and retain employees through a very difficult labor market. The services we provide our clients are critical to the community. Thanks to OnCentive we are able to remain competitive as an employer. Their team is great to work with and without a doubt will help you maximize the amount your organization can recover.”

Tawny DeBolt, Neon HCM

"OnCentive has delivered millions of dollars in credits to our clients. We had them take a look at our business and they found over $100k in cash refunds for our company. Their staff treats every one of our clients like they are their own and our clients and ecstatic we made the introduction."

Cliff Morgan, CFO Concrete Guys

"OnCentive has exceeded our expectations. We were skeptical on whether or not these programs would work for us but they absolutely made us believers. I would highly recommend them to any business looking to increase its profitability.”

Led by Tax Attorneys,

CPAs & Credit Experts

Our leadership has over 150 years of combined tax experience. With $3 billion in incentives captured, you are in good hands with OnCentive.

Quality Guaranteed

In the unlikely event that your credit is ever contested, the OnCentive team will defend our work and will fully refund any credits that are disallowed.

Maximum Credit Yield

Our profitability is tied with yours. We work off success fees which means we are motivated to find the maximum credits your business can qualify for.

(855) 566-0829

info@oncentive.com

2127 1st Ave N

Birmingham, AL 35203

<script type=" text=""/>

<script type=" text=""/>